Housing has always been an issue in India. With property prices soaring exponentially, year after year, people with middle-class incomes are practically horrified at just the thought of falling into the procedure of buying a house. Those who fall below the poverty line and those in the labour force don’t even dare dream of owning property or dream of days when they can call an apartment their own.

In the wake of such plight faced by the poor, the Government of India launched the Pradhan Mantri Awas Yojana, which was initiated in 2015.

Main objective of the scheme

Pradhan Mantri Awas Yojana or PMAY primarily aims to provide affordable housing for first-time homeowners. It aims to build pucca homes consisting of basic facilities like gas, electricity, and most importantly, water.

Eligibility criteria for the Pradhan Mantri Awas Yojana

The eligibility criteria are essential to know if you intend to apply for the PMAY. You are considered to be eligible for the PMAY if your annual income belongs to the following categories.

- Economically Weaker Section (EWS): Your family’s annual income should not be more than Rs. 3 lakh.

- Lower Income Group (LIG): Your family’s annual income is between Rs. 3 lakh and Rs. 6 lakh.

- Middle Income Group-I (MIG-I): Your household’s annual income is between Rs. 6 lakh to Rs. 12 lakh.

- Middle Income Group-II (MIG-II): Your family’s income is above Rs 12 lakh but below Rs 18 lakh.

How can one apply for the Pradhan Mantri Awas Yojana?

If you qualify among any of the economical categories mentioned above, you can follow the steps mentioned herewith:

- Identify the category under which you qualify for the PMAY

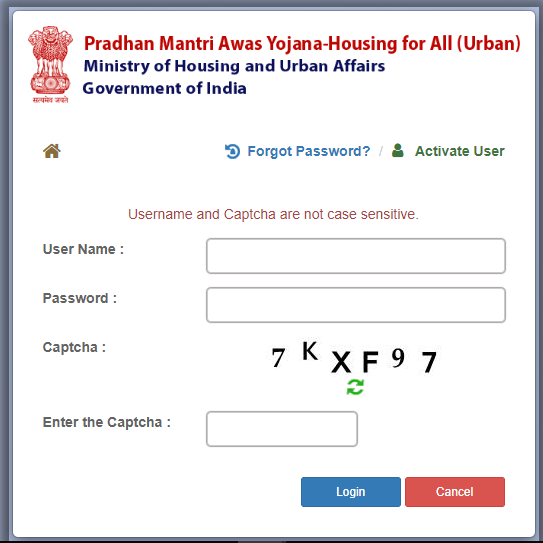

- Visit the website: http://pmaymis.gov.in.

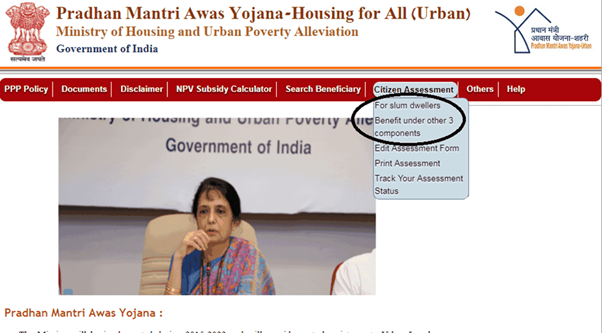

- You can then click on the ‘Citizen Assessment’ under the main menu and select the applicant category

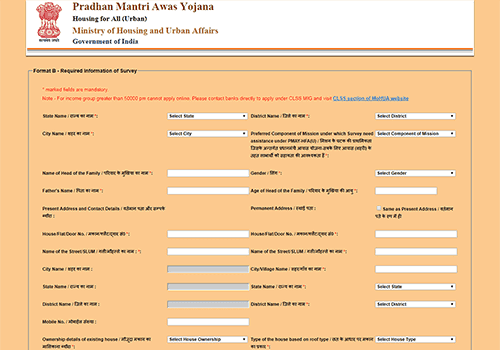

- You will be then redirected to a different page where you must enter your Aadhaar details

- Once you have filled all of that up, fill out the online PMAY application with your personal income, and bank account details and current residential address.

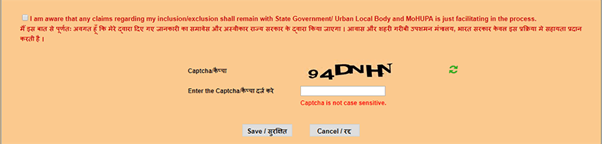

- Enter the captcha code that comes up, verify one last time to see of all your details are true and correct and hit ‘Submit’.

Offline Application

There are offline applications also available, in case some find it to be a more comfortable procedure. To apply offline, one can simply visit the government Common Service Centre and fill up the application form for a meagre sum of Rs 25 plus GST.

Please make a thorough note that no private centre or banks are allowed to undertake the procedure of taking in offline applications for PMAY.

In conclusion

With this scheme in place, housing gets infinitely convenient for people who find investing in a house not only a tedious but also a daunting process. In the long run, with more people managing to avail the benefits of the scheme, we will get a glimpse of a nation that is well-housed and comfortable