Housing is one of the most basic needs. Without shelter, it really gets hard for people to get about focussing on other aspects of their day. And as times go on, housing is increasingly an issue for people all over the country, as property rates keep skyrocketing year after year.

The Assam government is accepting applications for the Aponar Apon Ghar home loan subsidy scheme, which is a loan designed to help the residents of Assam find a roof over their head which they can call their own.

Through the Aponar Apon Ghar scheme, the state government will offer financial assistance to people to be able to afford their houses.

About the Aponar Apon Ghar Scheme subsidy?

The state government of Assam is willing to offer a ₹2.5 lakh subsidy on home loans of up to ₹40 lakh. This house loan subsidy is only for those who are purchasing their 1st house and have not availed any loans under any previous Aponar Apon Ghar scheme. Under the scheme, all applicants will get a home loan at subsidized rates.

This is an extension of a pre-existing scheme and under the state home loan scheme, the state government will provide an interest subsidy of 3.5% for government employees on home loans for up to ₹15 lakh taken for a 20-year duration.

The main purpose of the scheme is to enable more people in Assam to be able to purchase their own house and to help them realize the vision of “Housing for all”.

How to apply for the Aponar Apon Ghar scheme?

If you are a resident of Assam and wish to apply for the scheme, here is how you can go about it

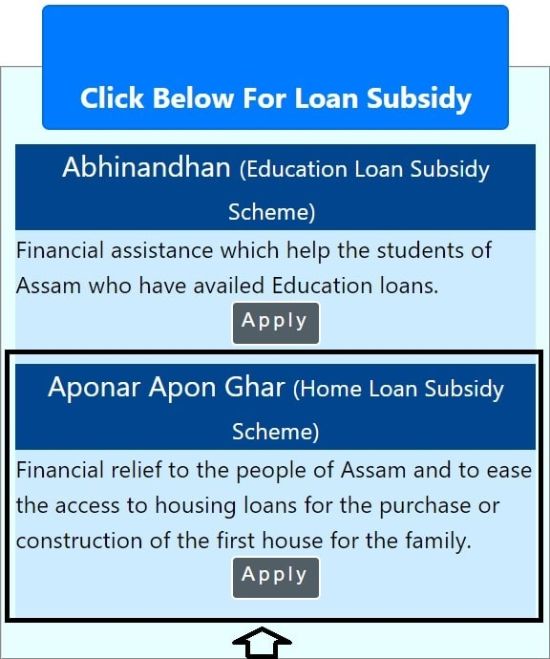

- Visit the official link of the website at https://assamfinanceloans.in/subsidy/welcome

- On the homepage, click on the “Apply” link under “Aponar Apon Ghar”

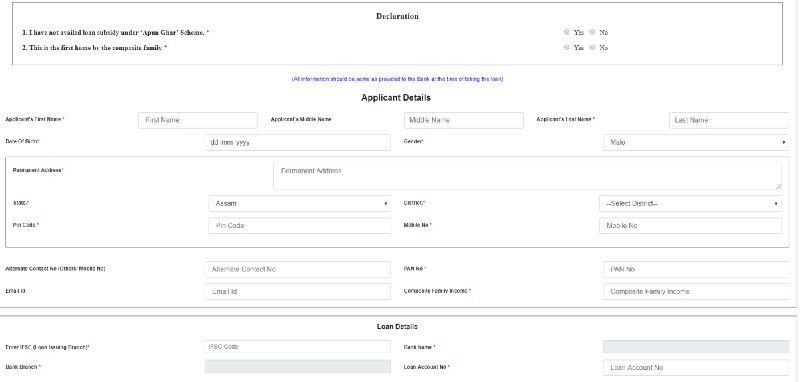

- Once you click on this link, there will be an online application form opening up, which will appear to be as follows:

- On this form, the applicant is expected to fill out the necessary details and upload supporting documents like loan proof, address proof, and PAN card and click at the “Save” button to complete the application form procedure in the end.

This scheme offers financial assistance to people in Assam to buy their house and offers ease for purchasing or construction of the 1st house for the family.

Eligibility criteria for the Aponar Apon Ghar scheme?

- The applicant should be a resident of Assam.

- The applicant must avail of housing loans from any scheduled commercial bank, regional bank, Assam co-operative apex bank within the state.

- The housing loan must be more than ₹5 lakhs and should be sanctioned by the bank on or after the 1st of April.

- Those who have already benefited from the scheme are no longer eligible to benefit from the scheme.

- The loan accounts must not be under the NPA (non-performing assets) status.

- This should be the first home by the composite family.